Access Control Systems for Finance Institutes

Fortify security and elevate efficiency with electronic locking

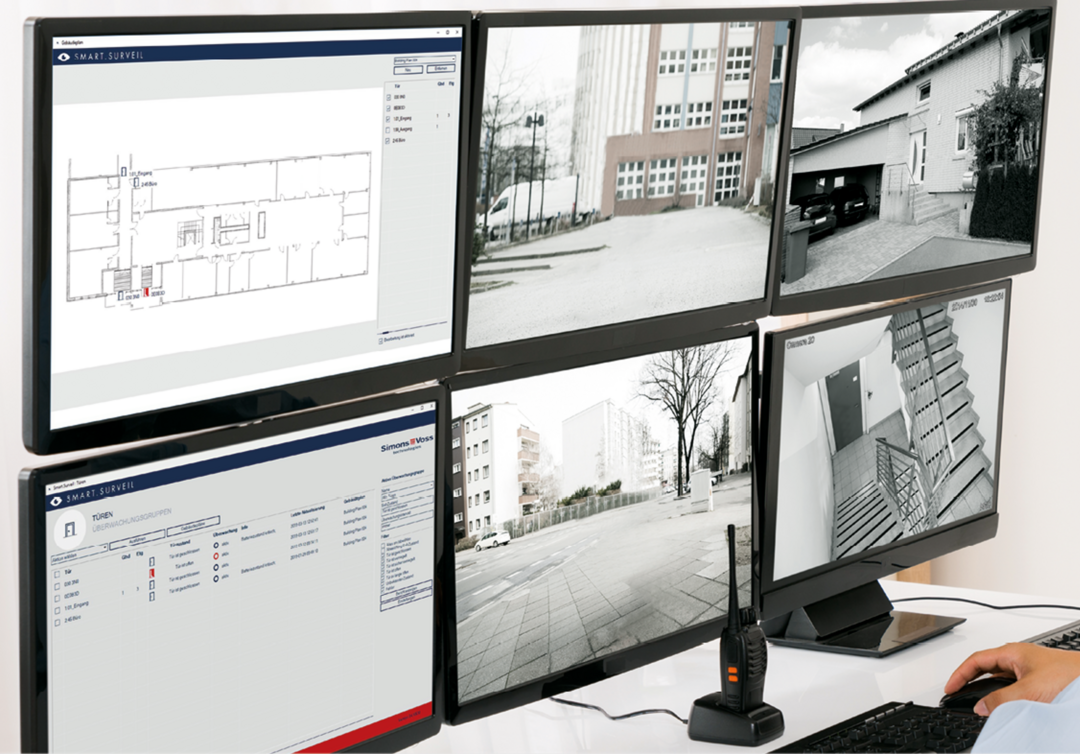

In the finance industry, security is non-negotiable. SimonsVoss offers keyless access control solutions that not only meet but exceed the stringent security requirements of financial institutions. Protect sensitive data, manage access seamlessly, and ensure the safety of your premises round the clock.

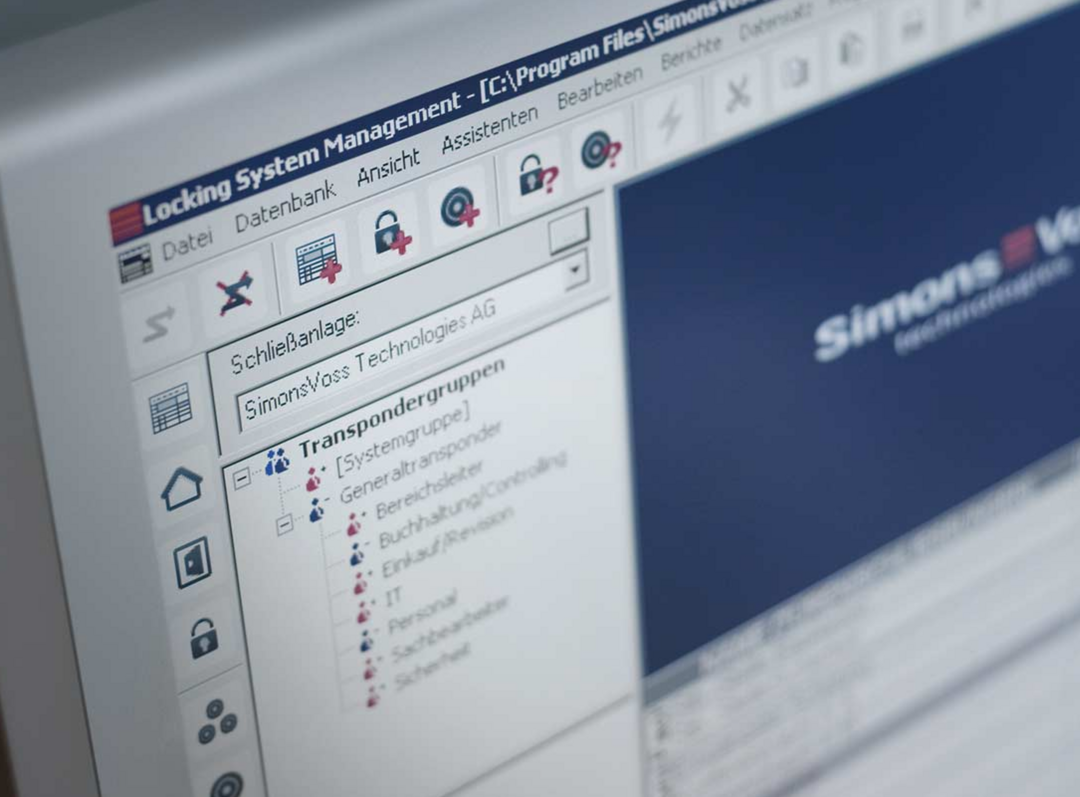

The all-inclusive solution: System 3060

Requirements:

- Separation of customer and employee areas

- Networking of individual branches

- Access authorisation for certain rooms for authorised employees only

These requirements and activity in different areas show that there is a great deal which needs controlling. Besides customers and employees, there are also external service employees such as cleaning staff.

Another aspect to consider: not only is door security important. It is also essential to control other authorisations – be it for access barriers or cabinets with sensitive data.

The solution:

System 3060 is the right solution for all the requirements that banks and financial institutions impose on a modern locking system.

- Access control with simultaneously automated documentation

- Quality assurance through automatic event logging and automatic processes

- Active security thanks to mapping of restricted access areas (e.g. safe deposit boxes, vaults)

- Passive security by deterring theft and abuse

- Low costs thanks to sustainability, durability, minimal power consumption, upward and downward compatibility, connection to third-party systems and more

Security in financial institutions

Checklist

Our checklist shows you options for using digital locking technology in the financial sector.